What is VAT?

VAT is a tax on the consumption of

goods and services levied at the point

of sale and has been set at 5 per cent

across GCC countries. This rate is

among the lowest in the world, with

some countries charging VAT of more

than 20 per cent.

Where can I read more about it?

The official title is Federal Decree-Law

No. (8) of 2017, on Value Added Tax.

An English version is available on the

UAE Federal Tax authority website

(https://www.tax.gov.ae).

VAT puts a standard rate of tax

(5%) on goods and services – why

is it complex?

Several reasons:

1) Not everything will be taxed.

2) There are new legal concepts (and a

bit of jargon) to understand.

3) Some things – like the place of

supply of electronic services – can be

quite difficult to define.

4) The GCC is a customs union – so,

implementing national VAT laws and

keeping the benefits of a transnational

economic bloc may be a challenge.

5) Some GCC states (like the UAE)

are further ahead than others, so all

GCC states may not implement VAT on

January 1, 2018.

Why isn’t everything taxed?

1) Some goods and services (for

example education and healthcare)

provide social benefits, so the

government doesn’t want to make

them more costly than necessary.

2) A few things like “bare” land cannot

be consumed (and VAT is a tax on

consumption).

3) Some things (for example some

financial services) are too difficult to

tax.

4) Various goods and services are

not taxed because they are exempt;

others are not (in effect) taxed because

the tax is 0% (zero-rated supplies).

All such supplies are VAT-free to the

consumer, but whether the supply is

exempt or zero-rated will make a big

difference to the taxable entity making

the supply.

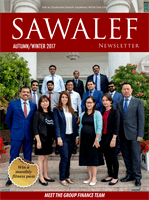

Here are some of the most commonly asked questions…

What does it mean for you?

FEATURE